Drawing from deep expertise and comprehensive insights into global merchant acquiring market challenges, MuRong Technology introduces the MuRong Merchant Acquiring System (MuRong MAS). This innovative solution effectively addresses critical industry pain points, offering a seamless payment environment that drives business growth and optimizes operational efficiency.

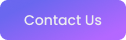

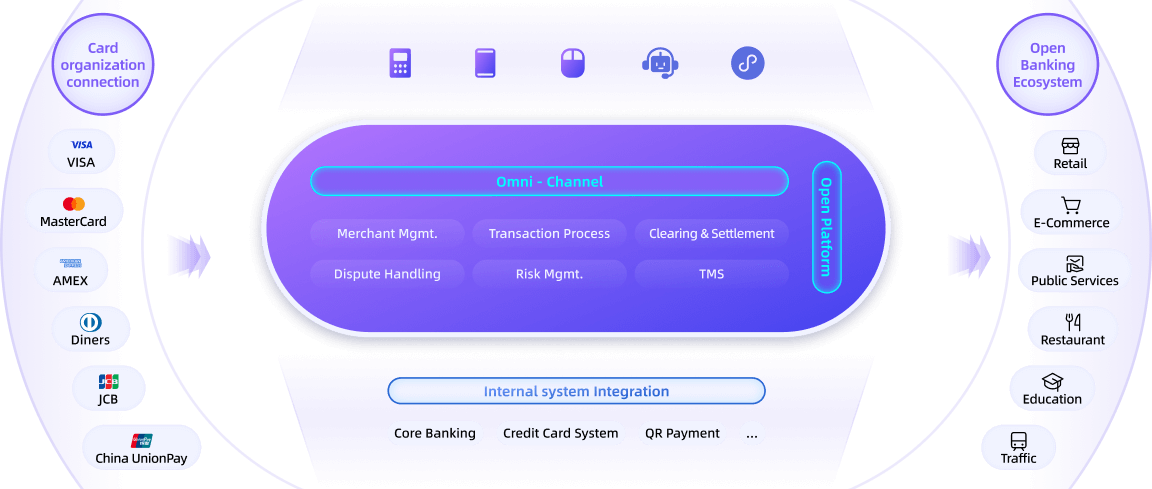

Built upon an advanced distributed microservices architecture, MuRong MAS supports flexible cloud deployments and provides exceptional scalability and agility, enabling rapid responses to market shifts and fostering continuous business innovation. MuRong MAS comprises robust functional modules, including a payment gateway, transaction processing engine, comprehensive risk control, clearing and settlement mechanisms, compliance management, dispute resolution, and a merchant management platform. By integrating cutting-edge AI technology, MuRong MAS ensures continuous, 24/7 online customer support. The open API infrastructure allows for seamless integration across industries, positioning MuRong MAS as a modern, intelligent merchant acquiring solution embedded within an open, collaborative ecosystem.

why choose

MuRong MAS?

Enhanced Payment

Processing & Profitability

Enhanced Payment Processing & Profitability

MuRong MAS establishes a unified transaction service platform supporting omni-channel and multi-scenario processing, comprehensively enhancing payment processing capabilities and maximizing economies of scale.

Extensive Clearing Network

& Payment Account Support

Extensive Clearing Network & Payment Account Support

MuRong MAS offers built-in support for all major card schemes, national and regional payment switches, international payment networks, diverse payment acceptance devices, and core banking systems.

Flexible & Efficient

Clearing Services

Flexible & Efficient Clearing Services

With multiple settlement options and automated post-reconciliation settlement and reporting, MuRong MAS ensures rapid fund availability and significantly improves merchant cash-flow efficiency.

why choose

MuRong MAS?

Enhanced Payment

Processing & Profitability

Enhanced Payment Processing & Profitability

MuRong MAS establishes a unified transaction service platform supporting omni-channel and multi-scenario processing, comprehensively enhancing payment processing capabilities and maximizing economies of scale.

Extensive Clearing Network

& Payment Account Support

Extensive Clearing Network & Payment Account Support

MuRong MAS offers built-in support for all major card schemes, national and regional payment switches, international payment networks, diverse payment acceptance devices, and core banking systems.

Flexible & Efficient

Clearing Services

Flexible & Efficient Clearing Services

With multiple settlement options and automated post-reconciliation settlement and reporting, MuRong MAS ensures rapid fund availability and significantly improves merchant cash-flow efficiency.

Key features

of

MuRong MAS

Omni-channel

Supports POS terminals, mobile devices, and online channels, enabling seamless offline-to-online integration.

Aggregated Payment Methods

Facilitates diverse payment methods including QR codes, Apple Pay, Google Pay, Alipay, WeChat Pay, and various MMO-issued e-wallets.

Flexible Merchant Management

Offers comprehensive multi-terminal merchant management tailored to diverse operational needs.

Automated Operations

Automates exception handling, system alerts, reconciliation processes, and DevOps deployments, significantly enhancing operational efficiency.

Regulatory Compliance

Integrated compliance engine ensures strict adherence to AML regulations and industry-standard data security practices, effectively mitigating compliance risks.

High-Volume Transaction Support

Efficiently processes millions of daily transactions, with dynamic scaling to effortlessly manage high-volume surges.

Comprehensive Security Framework

Employs a multi-layer security framework, ensuring robust end-to-end protection.

Key features

of

MuRong MAS

Omni-channel

Supports POS terminals, mobile devices, and online channels, enabling seamless offline-to-online integration.

Aggregated Payment Methods

Facilitates diverse payment methods including QR codes, Apple Pay, Google Pay, Alipay, WeChat Pay, and various MMO-issued e-wallets.

Flexible Merchant Management

Offers comprehensive multi-terminal merchant management tailored to diverse operational needs.

Automated Operations

Automates exception handling, system alerts, reconciliation processes, and DevOps deployments, significantly enhancing operational efficiency.

Regulatory Compliance

Integrated compliance engine ensures strict adherence to AML regulations and industry-standard data security practices, effectively mitigating compliance risks.

High-Volume Transaction Support

Efficiently processes millions of daily transactions, with dynamic scaling to effortlessly manage high-volume surges.

Comprehensive Security Framework

Employs a multi-layer security framework, ensuring robust end-to-end protection.

Benefits

Benefits

Rapid Time-to-Market

MuRong MAS, an omni-channel acquiring solution supporting cross-platform independent deployment, enables banks to swiftly establish comprehensive acquiring systems. It significantly reduces dependency on legacy infrastructure, shortens deployment cycles, and maximizes return on investment (ROI).

Full-scenario Ecosystem Coverage

A standardized, open platform enables rapid integration with various industry ecosystems, including e-commerce, retail, utilities, and more. This comprehensive integration capability allows banks to swiftly address customized merchant needs, achieve cost-effective multi-scenario expansion, and accelerate market innovation.

Future-proof Technical Architecture

Leveraging microservices architecture and containerized deployment, MuRong MAS addresses current high-performance transaction requirements and offers the flexibility to integrate emerging technologies efficiently, eliminating redundant investments.

End-to-end Operations Management

MuRong MAS provides an integrated operations platform covering terminal management, transaction processing, risk monitoring, fund settlement, and merchant services. Unified management interfaces and automated operational tools help banks build secure, highly efficient acquiring systems, substantially reducing operational costs and enhancing competitive positioning.

Benefits

Benefits

Rapid Time-to-Market

MuRong MAS, an omni-channel acquiring solution supporting cross-platform independent deployment, enables banks to swiftly establish comprehensive acquiring systems. It significantly reduces dependency on legacy infrastructure, shortens deployment cycles, and maximizes return on investment (ROI).

Full-scenario Ecosystem Coverage

A standardized, open platform enables rapid integration with various industry ecosystems, including e-commerce, retail, utilities, and more. This comprehensive integration capability allows banks to swiftly address customized merchant needs, achieve cost-effective multi-scenario expansion, and accelerate market innovation.

Future-proof Technical Architecture

Leveraging microservices architecture and containerized deployment, MuRong MAS addresses current high-performance transaction requirements and offers the flexibility to integrate emerging technologies efficiently, eliminating redundant investments.

End-to-end Operations Management

MuRong MAS provides an integrated operations platform covering terminal management, transaction processing, risk monitoring, fund settlement, and merchant services. Unified management interfaces and automated operational tools help banks build secure, highly efficient acquiring systems, substantially reducing operational costs and enhancing competitive positioning.